WWW.SOLUTIONFANS.COM - MASTER OF ALL EXAM RUNS

ECONOMICS OBJ:

1DBCDCDBCCD

11BAABABDBDB

21BCBDBCCACC

31CBBDDBCDBA

41BBCBDCCACC

COMPLETED!!!

ECONOMICS ESSAY:

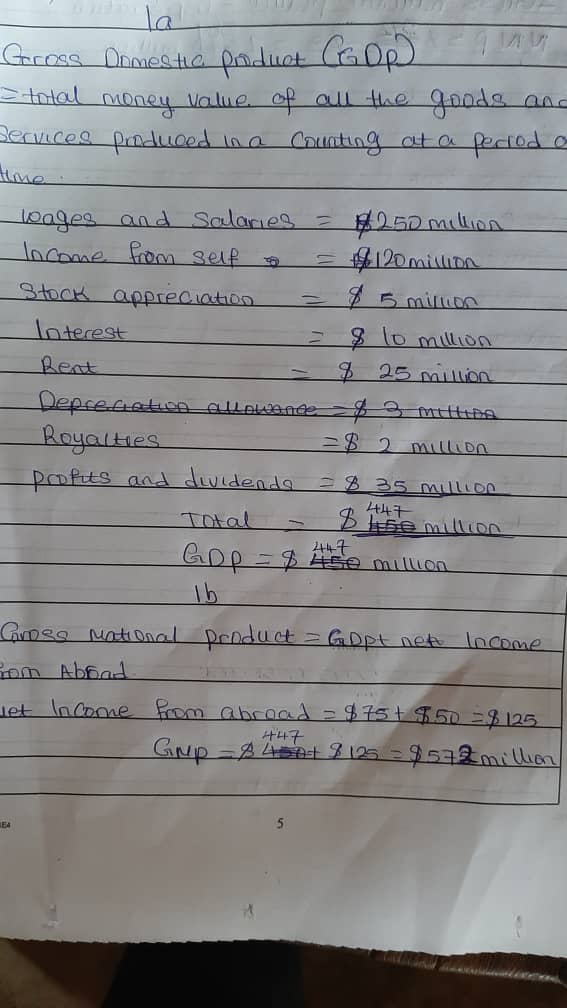

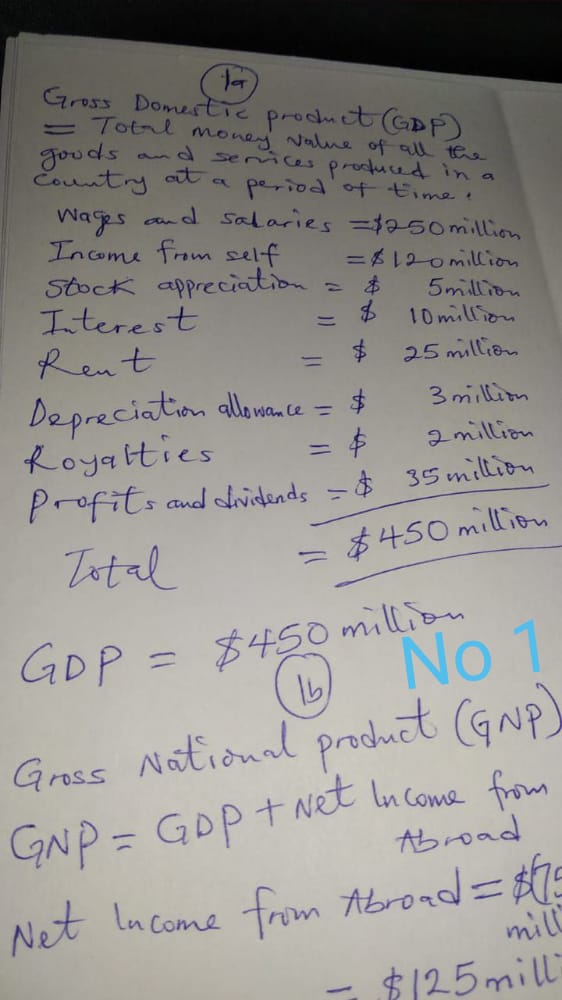

(2ai)

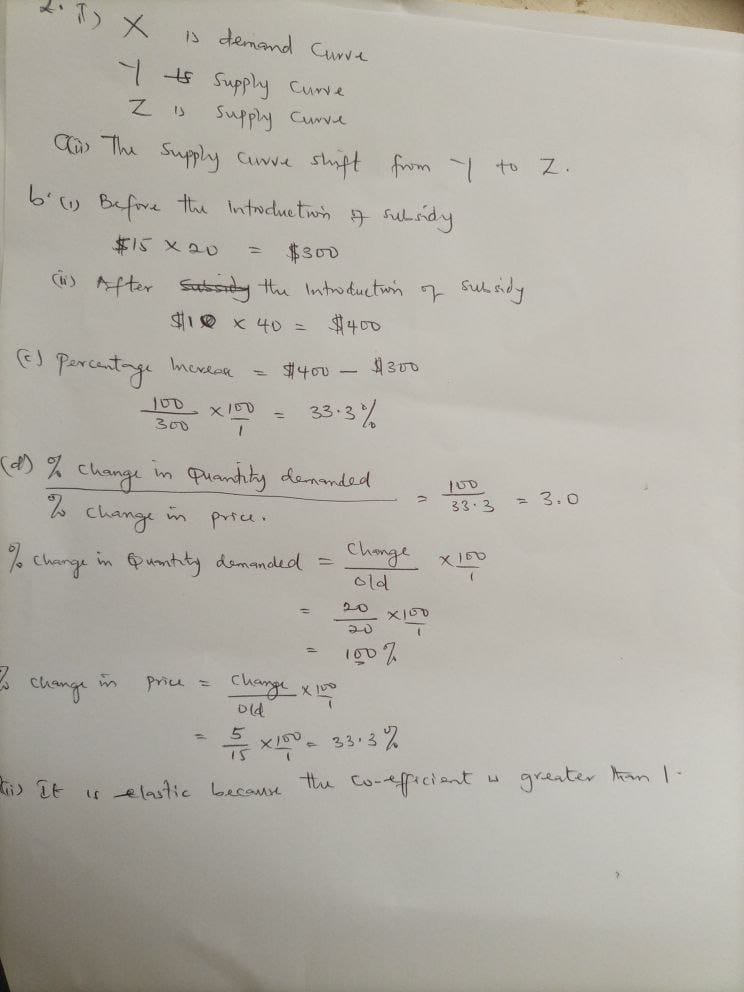

X is demand curve

Y is supply curve

Z is supply curve

(2aii)

The supply curve shift from Y to Z

(2bi)

Before the introduction of subsidy

$15×20 = $300

(2bii)

After the introduction of subsidy

$10×40 = $400

(2c)

Percentage increase = $400-$300 = $100

100/300 × 100/1 = 33.3%

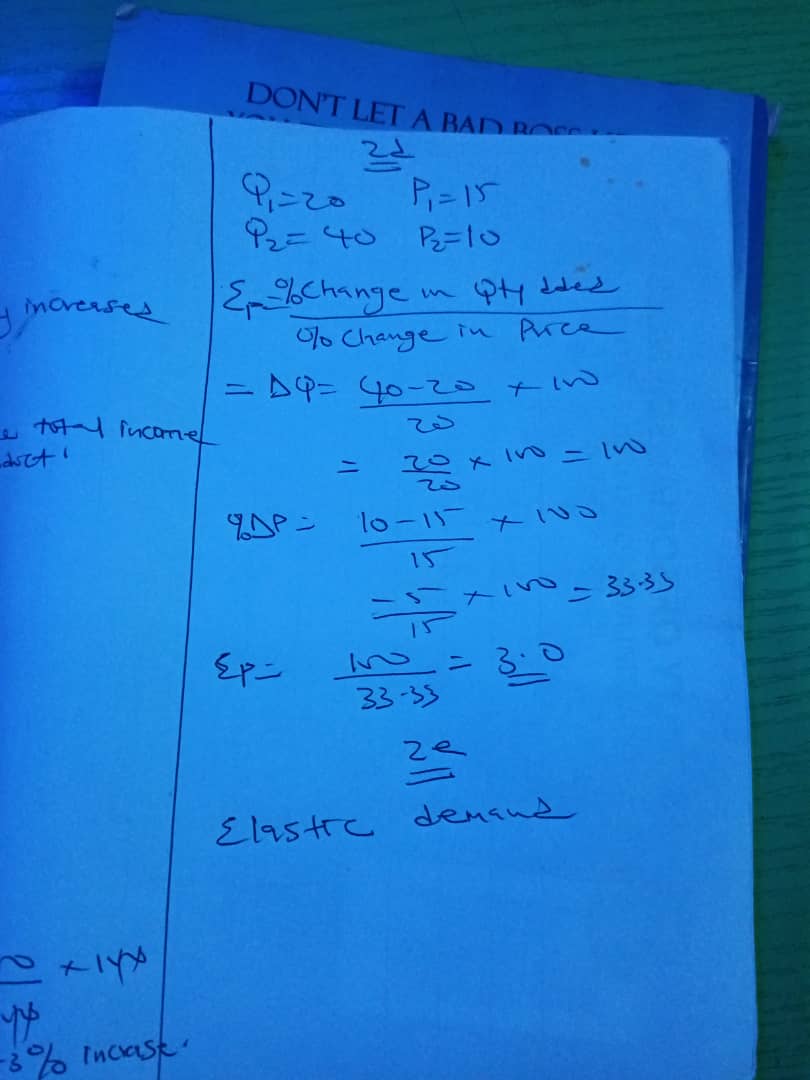

(2di)

% change in quantity demanded/ % change in price = 100/33.3 = 3.0

% change in quantity demanded= change/old × 100/1

= 20/20 × 100/1

= 100%

% change in price = change/old × 100/1

= 5/15 × 100/1 = 33.3%

(2dii)

It is elastic because the coefficient is greater than 1

===========================

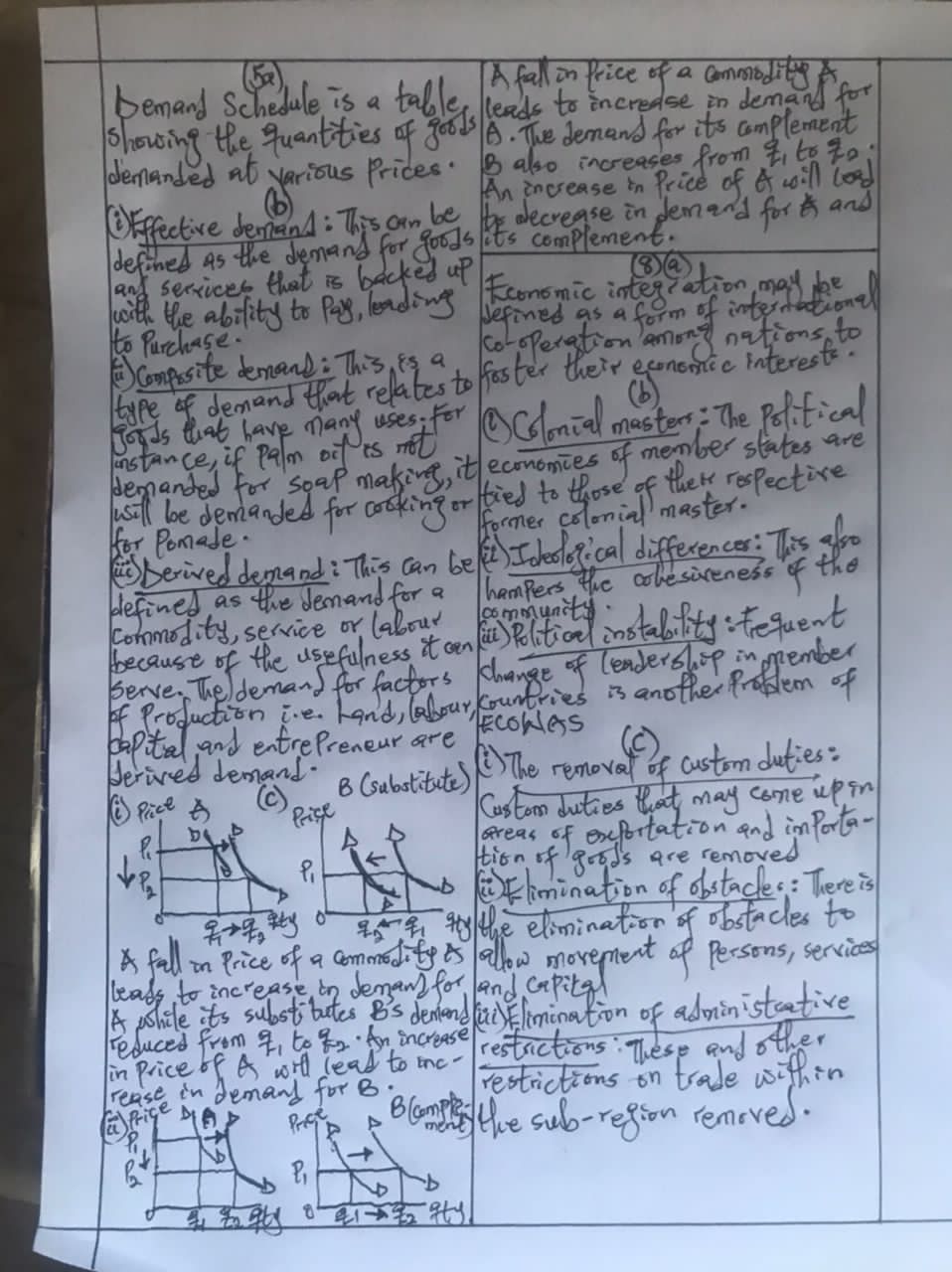

(5a)

Demand schedule is the table that shows the relationship between quantity demanded and price of goods.

Or

It can be defined as the list showing the number of quantities of a commodity demanded at various prices.

(5b)

(i). Effective demand: this is the type of demand which is supported with the ability and willingness to pay.

(ii). Composite Demand: Demand is composite when a commodity can be used for more than one purpose

(iii). Derived Demand: It occurs when a commodity is wanted not for the satisfaction it yields but for the reason that they are useful in producing another commodity.

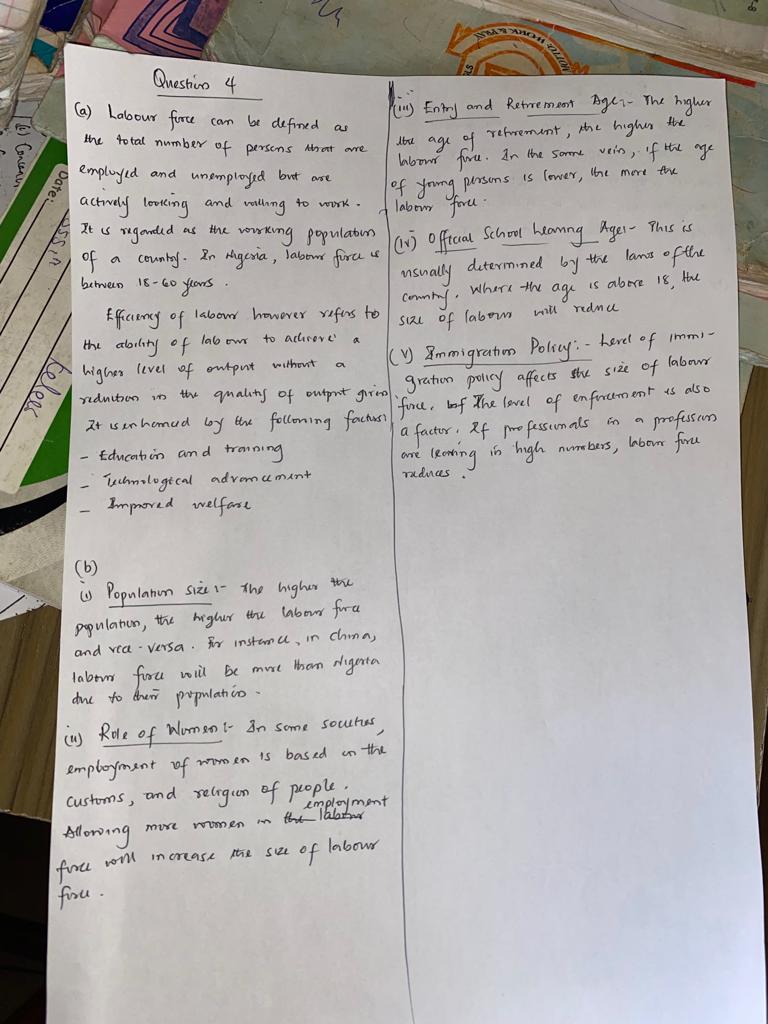

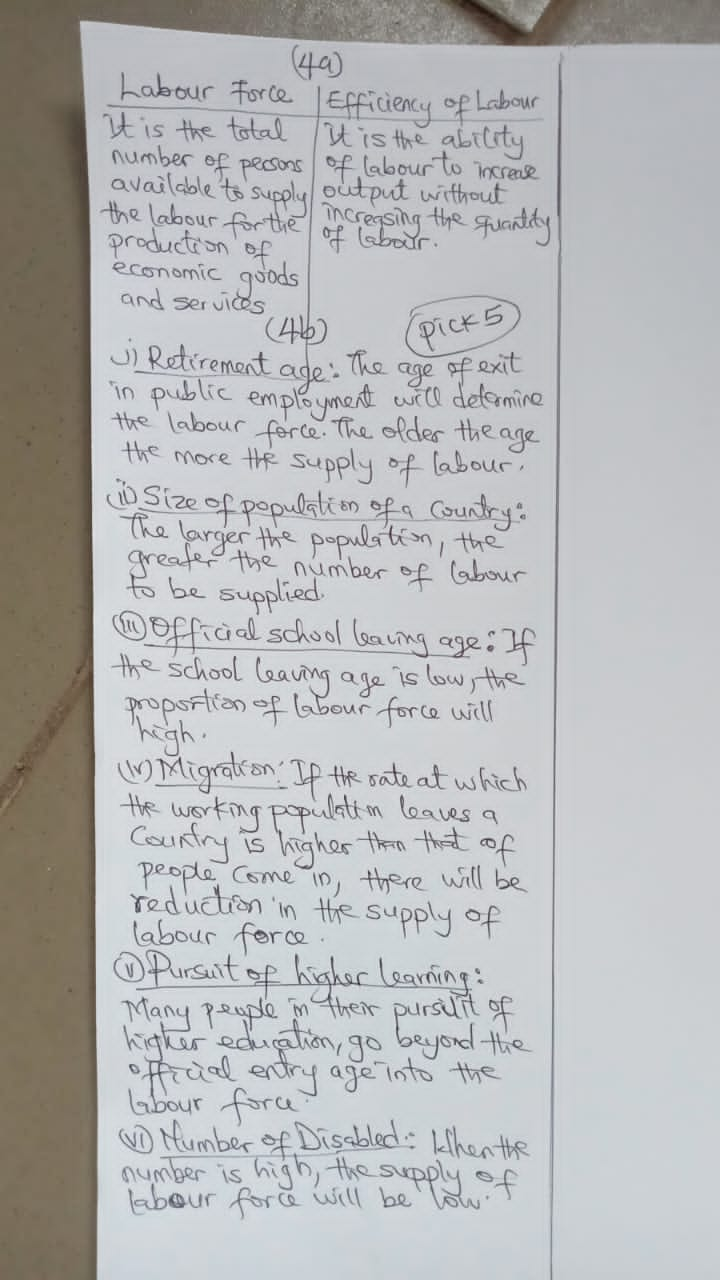

(4a)

(i)Labour force: Labour force can be defined as the total number of persons available to supply the labour for the production of economic goods and services. In other words, it is the total number of people of working age in a country who are able and willing by law to work.

(ii)Efficiency of labour: Efficiency of labour may be defined as the ability of labour to increase output without increasing the quantity of labour. Increase in efficiency is usually expressed in terms of increase in output of labour within a shorter period of time without any fall in the quality of goods and services produced.

(4b)

(PICK ANY FIVE)

(i)Age structure of the population: The structure of a country’s population is a significant determinant of the size of the labour force. The lower the dependant people, the higher the supply of labour and vice versa. In otherword, the labour force will increase in a country with a greater number of its people between the ages of 18 and 65 years.

(ii)Role of women in the society: In some societies, women are usually prevented from engaging in gainful employment because of religious belief, social and cultural factors and this affects the size of labour force.

(iii)Number of working hours and working days: The number of working hours per day and the number of working days in a week or a year also helps to determine the supply of labour.

(iv) The number of disabled: When the number of disabled persons is high especially within the working population, the supply for labour will be low.

(v) The number of people unwilling to work: There are certain number of able bodied people who are also between the age bracket of 18 and 65 years but are unwilling to work. If their population is high, it will affect the size of supply of labour

(vi) Migration: The rate of migration can also affect the size of labour force. If the rate at which the working population leaves a country is higher than the rate at which people come in, it will lead to reduction in the supply of labour.

(vii)Trade union activities: The activities of trade union may also affect the supply of supply. For example, when a long period of training is imposed on a certain trade, this may discourage people from engaging in such trade or profession leading to a reduction in supply of labour.

(viii)Government policies: Certain government policies can affect the supply of labour. E.g. specific

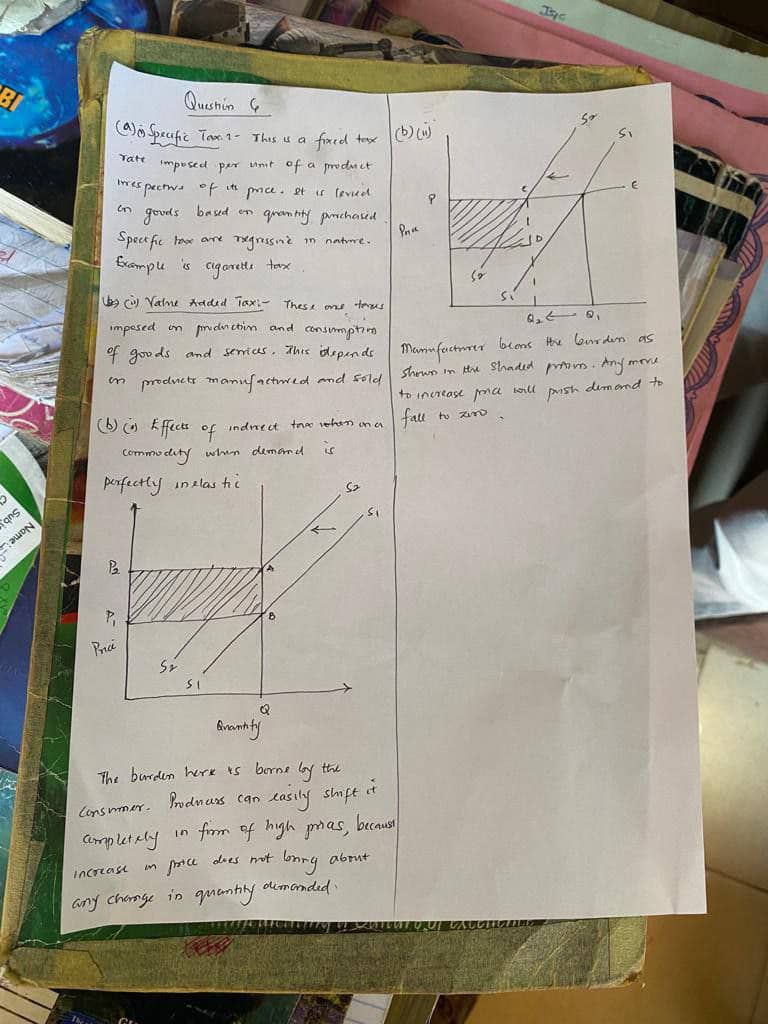

No 6a

i. Specific tax

A specific tax is a fixed amount of tax placed on a particular good. It is also referred to as a per-unit tax, and the tax will depend on the quantity sold (not price).

ii. Value-added tax (VAT) : is a flat tax levied on an item. It is similar to a sales tax in some respects, except that with a sales tax, the full amount owed to the government is paid by the consumer at the point of sale. With a VAT, portions of the tax amount are paid by different parties to a transaction.

======================

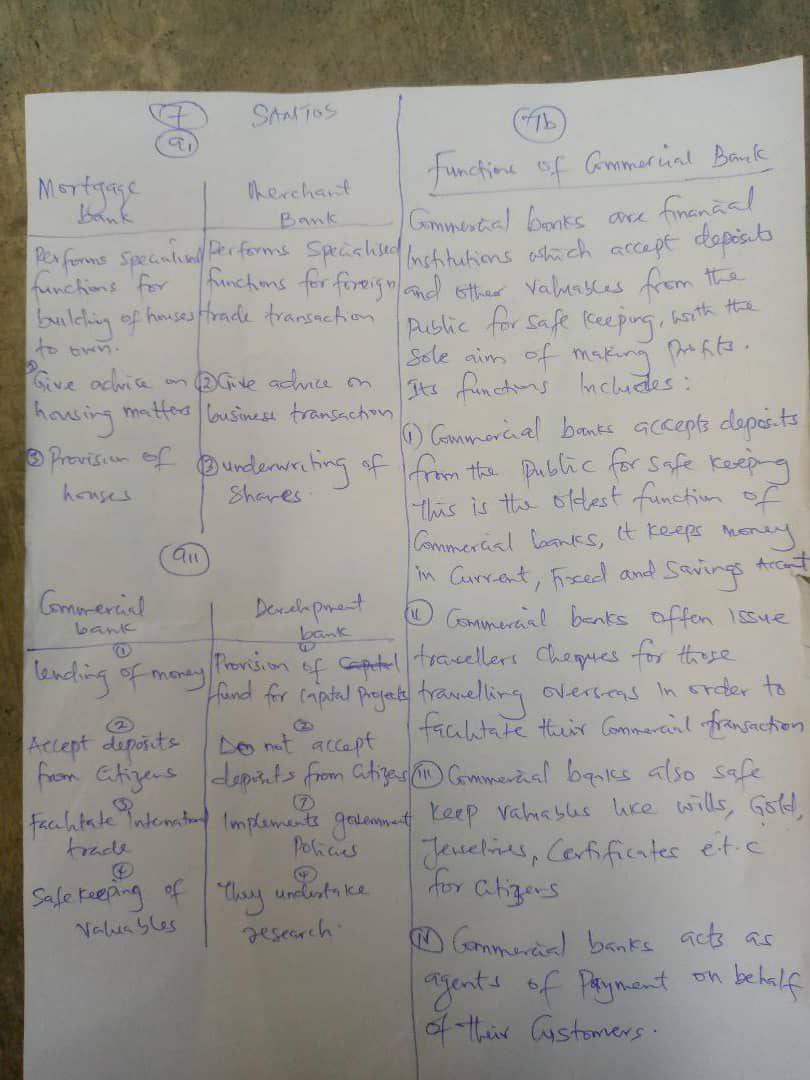

(7a)

(i) A Merchant Bank is that Mortgage is a bank or company which offers a loan with their own funds or from warehouse lenders WHILE A merchant bank is an institution which provides the services of finance, underwriting, offering business loan and advice or consultancy on finance.

(ii) Commercial Bank is the bank organized to perform public utility banking services, such as accepting deposits, lending money, etc. On the other hand, development bank refers to a multi-purpose financial undertaking set up to provide financial aid to the industrial and agricultural sector, to encourage development.

(7b)

(i) Agency functions: commercial banks are already agents of the banking system, but they can also be personal agents to their customers. An agent is an individual or institution that carries out activities, in this case, financial operations, on behalf of the principal (who is the customer) for a few known as a commission.

(ii) Credit Creation: commercial banks are perhaps the only financial institutions with this unique function. Commercial banks create credit through accepting deposits and providing loans, pushing money into the economy.

(iii) Transfer of funds: the transfer of funds from a customer’s account to another account is another vital function of banks. Fund transfer is a valid means of paying for transactions, as well as other financial activities. Transfer of funds can be carried out through several ways such as drafts, standing orders, cheques, USSD platforms, and electronic banking.

(iv) Provision of loans: besides accepting deposits, another function of commercial banks is the provision of loans. The provision of funds to those who require them for transactions is a vital role commercial banks play. Nowadays, customers can now have access to instant loans from commercial banks.

(8a)

Economic integration is an arrangement among nations that typically includes the reduction or elimination of trade barriers and the coordination of monetary and fiscal policies.

(8b)

(i)Political Instability in member states; This results in different approach to ECOWAS issues by leaders of member states.

(ii)Inadequate finance: Many members states do not fulfill their financial obligation as at and when due. This is crippling the effective operation

of ECOWAS.

(iii)Colonial linkage to erstwhile master; is another factor affecting ECOWAS. Francophone

nations that are members of ECOWAS may not lend their

weight to matters of the organisation that will negatively

affects France.

(8c)

(i)Road construction between big cities. The highways Lagos-Abidjan, Nouakchott-Lagos have made commuting much easier that it was before. The road network Elubo – Alflao – Lagos is one of the achievements.

(iii)The relations between the Anglophone and Francophone have been stabilized. It has been done thanks to the ECOWAS passport. It has significantly eased the movement of people within those areas.

(iii)Telephone network for the member states. Nowadays, interconnection is available for all countries of the African Union.

Completed

also don't forget to leave a Reply, we would very MUCH appreciate Your Comments On This Post Below. Thanks!

Please can you send us neco answers yoruba on Monday