WWW.SOLUTIONFANS.COM - MASTER OF ALL EXAM RUNS

Account OBJ:

1ACDBEEAEAB

11EEBECBCDDA

21DEBDEEACAC

31CBACBCBBDD

41DCDDDAAEEB

51EDDABBDDDE

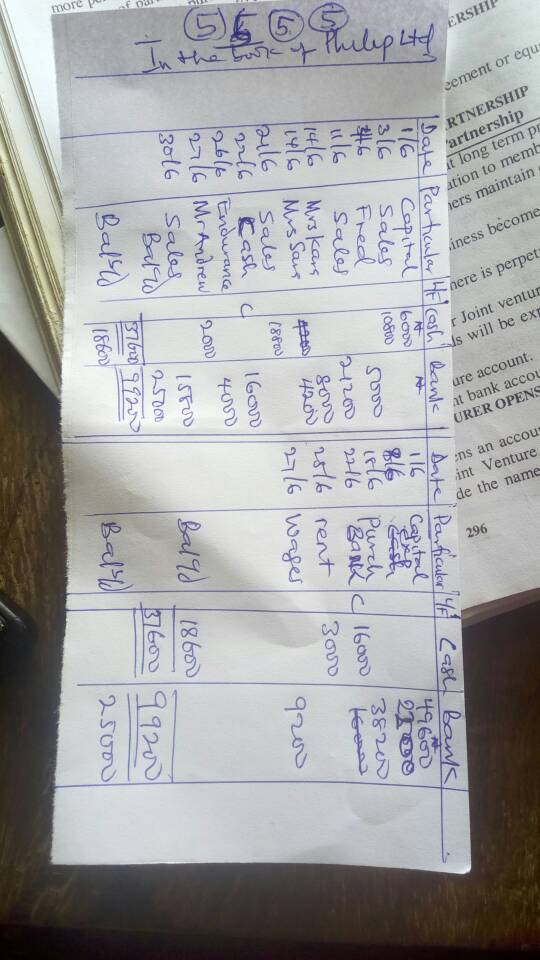

5)

Real Account: The accounts relating to all assets and properties are called real accounts.

2aii)

Personal Account: The accounts relating to induviduals, firms, associations or companies are known as personal account.

2aiii)

Nominal Account: The accounts relating to expenses, losses, incomes and gains are known as nominal accounts.

2b)

i)Managers

ii)Employees

iii)Competitors

iv)Government

v)Creditors

vi)Tax authorities

vii)Financial Analyst

1ai)

Uncredited cheques: Cheques received by business, paid into bank and debited in cash book but not yet cleared by bank and entered in its record.

1aii)

Unpresented cheques: Cheques drawn or paid by business and credited in cash book but these cheques have not yet been presented to bank for payment.

1aiii)

Dishonored Cheque is a cheque which is presented for payment and the drawer has insufficient fund in his or her account to cover the cheque which will then be returned to the payee marked “refer to drawer”

1iv)

The term bank charge covers all charges and fees made by a bank to their customers. In common parlance, the term often relates to charges in respect of personal current accounts or checking account.

1b)

The partnership deed must contain the following particular:

i)The name of the firm.

ii)The names and addresses of the partners.

iii)The nature of the business.

iv)The term or duration of partnership.

v)The amount of capital to be contributed by each partner.

4a)

i)the companies involved do not necessarily renounce their identity as natural or legal persons, but maintain their independence.

ii)the companies involved carry out a business, activity or project together, but without the need to change their identities as companies, as would happen, for example in a merger or take over.

iii)The most common cases of joint venture are between companies of different nationalities where one of them seeks to enter the market where the other is located, and where to achieve this it is necessary to overcome big trade barriers, make a big investment and Access to the know-how of the market.

4b)

i)A joint venture involves two or more companies joining together in business, whereas in a partnership, it is individuals who join together for a combined venture.

ii)A joint venture can be described as a contractual arrangement between two companies that aims to undertake a specific task. Whereas, a partnership involves an agreement between two parties wherein they agree to share the profits as well as any loss incurred.

iii)A partnership will last for many years until the parties involved have no differences. While a joint venture company will last for only a limited period until their goal is achieved.

iv)The members in a partnership can claim a capital cost allowance as per the partnership rules. Whereas, joint ventures can use as much or as little of the capital cost allowance.

4c)

Fixed assets:

-furniture and fittings

-plants and machinery

-land and building

current assets:

-stock

-debtors

-bank

-cash

579 total views, 1 views today

also don't forget to leave a Reply, we would very MUCH appreciate Your Comments On This Post Below. Thanks!