WWW.SOLUTIONFANS.COM - MASTER OF ALL EXAM RUNS

WAEC-COMMERCE-ANSWERS

Keep Subscribing With Us To

Enjoy Our Service And Get Your Legit.

Solution Before Exam Time.

=====================================

WAEC-COMMERCE-ANSWERS

COMMERCE-OBJ.

1BABBBBDBCD

11CCAACBBDCB

21DBBBADADBC

31DCBDDDCDBC

41CCCBCDDADC

=====================================

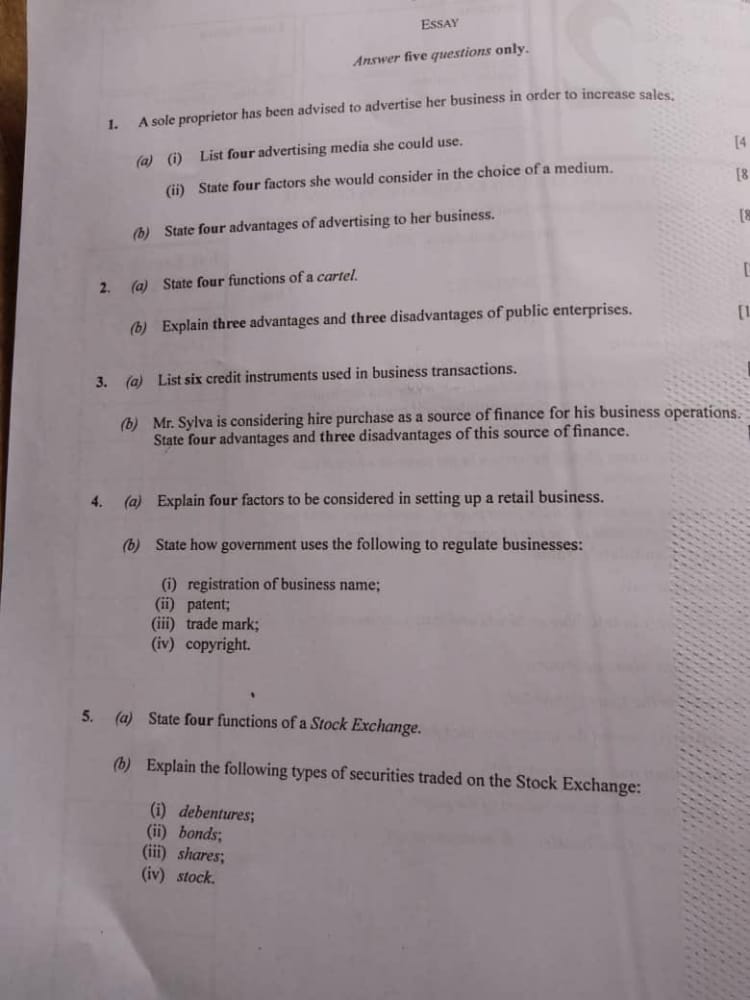

YOU Are To Answers Only Five Questions Out Of 1,2,3,4,5,6,8

=====================================

(3a)

(i) Bill of exchange

(ii) Hire purchase contract

(iii) Promissory note

(vi) Credit card

(v) Bank draft

(3b)

-ADVANTAGES-

(i) Can get a significant amount of money at the rate of time

(ii) Allows emergency purchases

(iii) Money may not need to be paid back

(iv) Can create space for more profitable uses

-DISADVANTAGES-

(i) Might not get the full market value of the assets or even be able to sell them at all

(ii) Money may be lost if the business fails

(iii) Difficult for a new business to access

=====================================

(4a)

(i)Best Location: One of the key starting points in putting up a retail store is the right location. Getting into an ideal business location is a sustainable advantage since a competitor can’t copy or steal your spot.

(ii)Competitive Factors: Competitive factors also impact effectiveness of a retail start-up. The ideal scenario exists when you start a distinct business that offers a sizable marketplace goods or services they value and can’t get elsewhere.

(iii)Financial Capital: You have two basic ways to start a retail business. You can build one from scratch or invest in a franchise, where you purchase the rights to an existing model.

(iv)Legal and Regulatory Environment: You also need to understand legal and regulatory facts that impact your industry. Some industries are heavily regulated, while others have minimal government regulations.

(4bi)

(i)Government regulates business name registration through CAC- Corporate Affairs Commission

(4bii)

Government patent use law is a statute that is a “form of government immunity from patent claims.

(4biii)

Government regulates trade mark through it’s trade mark law

(4biv)

The Commission is the Government agency responsible for all copyright matters in Nigeria including the administration, regulation.

=====================================

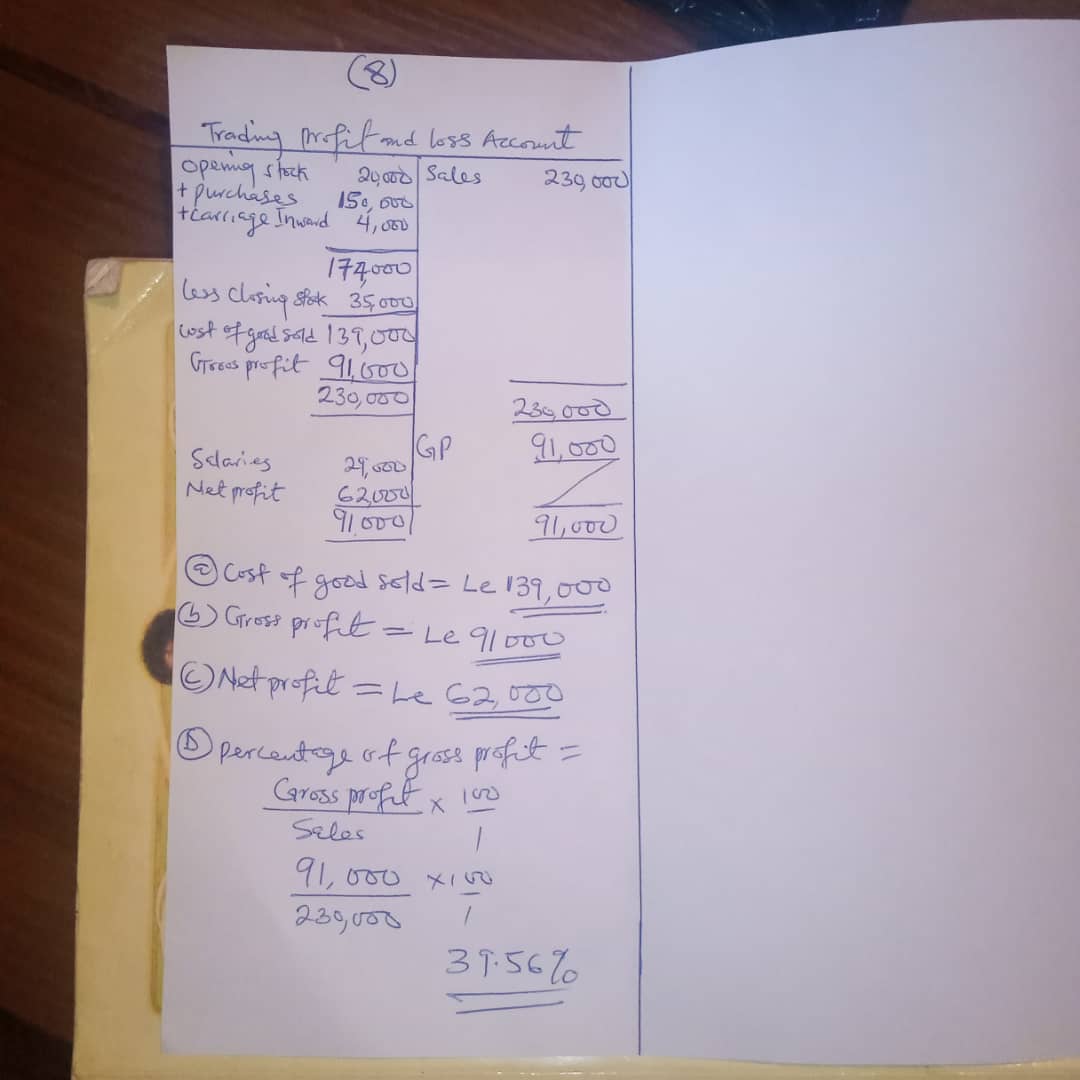

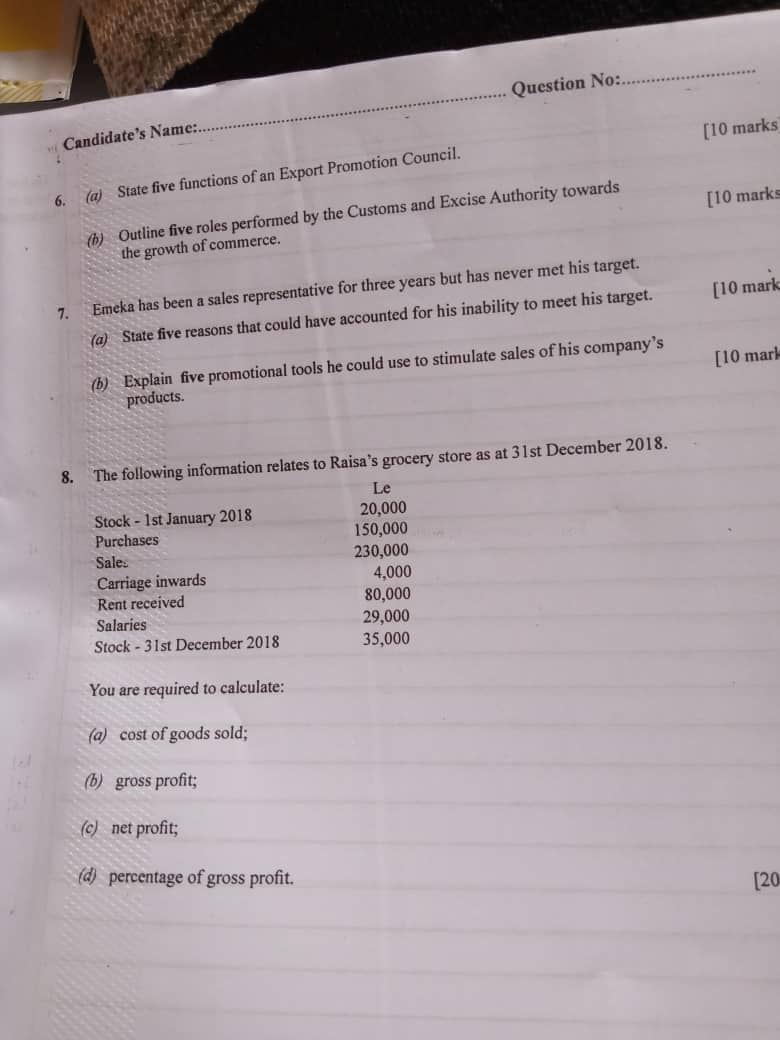

(8)

Trading profit and loss account

TABULATE

(Debit side)

Opening stock 20,000

Purchases 150,000

Carriage inward 4000

Less closing stock 35,000

Cost of goods sold 139,000

Gross profit 91,000

Total 230,000

Salaries 29,000

Net profit 62,00

Total 91,000

(Credit side)

Sales 230,000

GP 91,000

Total 91,000

(8a)

cost of goods sold = Le 139,000

(8b)

Gross profit = Le 91,000

(8c)

Net profit = Le 62,000

(8d)

Percentage of Gross profit Gross profit/sales * 100/1

91,000/230,000 * 100/1

39.56%

=====================================

(6a)

(i)Provides Technical Support To Exporters

(ii)Simplifies Export Procedures

(iii)Provides Grants And Incentives

(iv)Simplifies Export Procedures

(v)Provides Exportable Products’ List

(6b)

(i)Collect and revenue for the government by charging customs excise duties.

(ii)keep and analyse records of imported and exported goods and services.

(iii)Control bonded warehouses to ensure that duty is collected for imported dutiable goods before releasing them.

(iv)Supervise public health by arranging quarantine for animals, pets coming into the country thus controlling infectious disease.

(v)Supervise entrepots ( re-export) trade to ensure that no duty is charged and collected on goods destined to another country

=====================================

(1a)

(i) Radio

(ii) Television

(iii) Cinema

(iv) Catalogues

(1aii)

(i) Coverage or extent of circulation

(ii) The target audience

(iii) Cost

(iv) Frequency

(1b)

(i) It helps in creating job opportunities

(ii) It provide information about features

(iii) Reduction in price

(iv) Increase in profit

====================================

(5a)

(i)Economic Barometer:

A stock exchange is a reliable barometer to measure the economic condition of a country.

(ii)Pricing of Securities:

The stock market helps to value the securities on the basis of demand and supply factors

(iii)Safety of Transactions:

In stock market only the listed securities are traded and stock exchange authorities include the companies names in the trade list only after verifying the soundness of company.

(iv)Spreading of Equity Cult:Stock exchange encourages people to invest in ownership securities by regulating new issues

(5bi)

Debenture: A debenture is a document which acknowledges a loan generally under the company’s seal,bearing a fixed rate of interest . it usually gives security for replacement of loan as well as the interest. Holders of debenture certificate have no voting right

(5bii)

Bond : A bond is a security issued by a government or its agency or private institution as a means of raising fund. Bonds are usually due to be redeemed at some future date,and they carry a fixed rate of interest.

(5biii)

Shares: Shares can be defined as an individual portion of the company’s capital owned by shareholders. It is the interest which a shareholder has in a company . in other word, a share is a unit of capital measured by a sum of money.

(5biv)

Stock: stock can be defined as the bundle of shares or mass of capital which can be transferred in fractional amount. They are always fully paid ,e.g it can be quoted per #100 nominal value.

====================================

(2a)

(i)improving the profitability of the firm.

(ii)Carrying out restriction of output ,

(iii)control of price,

(iv)allocation of market shares.

(2b)

-Advantages-

(i)They base their decisions on the full costs and benefits

involved.

(ii)They can be used to influence economic activity. To boost the country’s output, public corporations can be directly encouraged to increase their output.

(iii)In cases where it is practical to have only one firm in the industry, such as rail infrastructure, a public corporation would not abuse its market power.

-Disadvantages-

(i)They can be difficult to manage and control. The large size of theorganisations may mean that time has to be spent on meetings and communicating with staff, slowing down decision making.

(ii)They may become inefficient, produce low quality products and charge relatively high prices, due to a lack of competition and the knowledge that they cannot go bankrupt.

(iii)They will need to be subsidized if they are loss making. The use of tax revenue to support them has an opportunity cost it could be used to spend on, say, training more teachers and nurses.

====================================

Theory Completed.

Www.Solutionfans.Com

Love You All.

also don't forget to leave a Reply, we would very MUCH appreciate Your Comments On This Post Below. Thanks!